In 2018 Malaysia set a 20 target of renewable energy in the countrys energy mix by 2025. Generally a loss generated in tax years ending before January 1 2018 may be carried back two years and if not fully used carried forward 20 years.

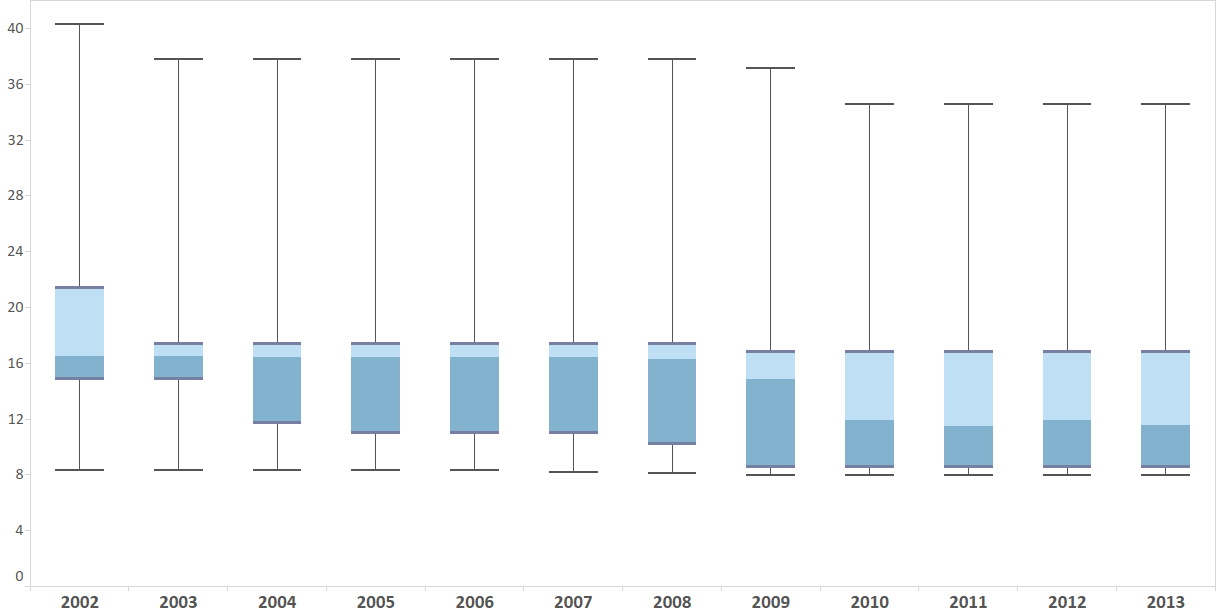

Measuring Tax Support For R D And Innovation Oecd

The BOI by virtue of the Investment Promotion Act of 1977 including its amendment no.

. Pulau Pinang is a Malaysian state located on the northwest coast of Peninsular Malaysia by the Malacca StraitIt has two parts. Malaysia offers a wide range of tax incentives for the promotion of investments in selected industry sectors which include the traditional manufacturing and agricultural sectors as well as. Superceded by the Tax Audit Framework 01042018 - Refer Year 2018.

SST Treatment in Designated Area. Penang Island where the capital city George Town is located and Seberang Perai on the Malay PeninsulaThey are connected by Malaysias two longest road bridges the Penang Bridge and the Sultan Abdul Halim Muadzam Shah. Tax Audit Framework On Finance and Insurance Superceded by the Tax Audit Framework On Finance and Insurance 18112020 - Refer Year 2020.

Different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions. Malaysia Sales Tax 2018. Malaysia Sales Tax 2018.

4 2017 and the Competitive Enhancement Act 2017 provides tax incentives for certain activities within the following categories. Board of Investment BOI tax incentives. The policy has been reinforced by fiscal incentives such as investment tax allowances and the Small Renewable Energy Programme SREP which encourages the connection of small renewable power generation plants to the national grid.

SST Treatment in Designated Area and Special Area. Tax Exemption On Rental Income From Residential Houses. 2018 EEC Act an EEC project must be located in certain zones within the.

Special rules regarding NOLs generated in tax years ending before January 1 2018 may apply 1 to specified liability losses or 2 if a taxpayer is located in a qualified disaster area. Malaysia Service Tax 2018. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

Tax Audit Framework On Withholding Tax available in Malay version only 01082015. Malaysia Service Tax 2018.

Why Is Solar Energy Getting 250 Times More In Federal Tax Credits Than Nuclear

Taxation In Bangladesh Incentives Transfer Pricing Dtas Repatriation

6 Reason To Invest In Malaysia Stock Exchange Financial Management Stock Exchange Investing

Electric Car Market Share Financial Incentives Country Comparison Incentive Financial Share Market

Individual Income Tax In Malaysia For Expatriates

Updated Guide On Donations And Gifts Tax Deductions

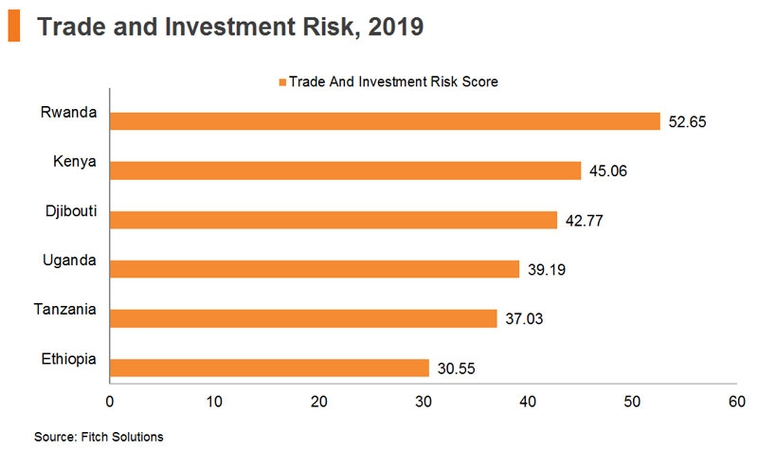

Section 4 Regulations Tax Incentives In Ethiopia Hktdc Research

Tax Incentives For Green Technology In Malaysia Gita Gite Project

North Carolina Providing Broad Based Tax Relief Grant Thornton

China Annual One Off Bonus What Is The Income Tax Policy Change

Tax Incentives And Foreign Direct Investment In Developing Countries Austaxpolicy The Tax And Transfer Policy Blog

Iit Subsidies In China S Greater Bay Area File Your 2021 Application Now

Pemerkasa Assistance Package Crowe Malaysia Plt

North Carolina Providing Broad Based Tax Relief Grant Thornton

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Asiapedia India S Tax Incentives Dezan Shira Associates

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Applying For Digital Transformation And Carbon Neutrality Tax Incentives Global Employer Services Deloitte Japan